Inflation Holds Steady as Consumer Spending Declines

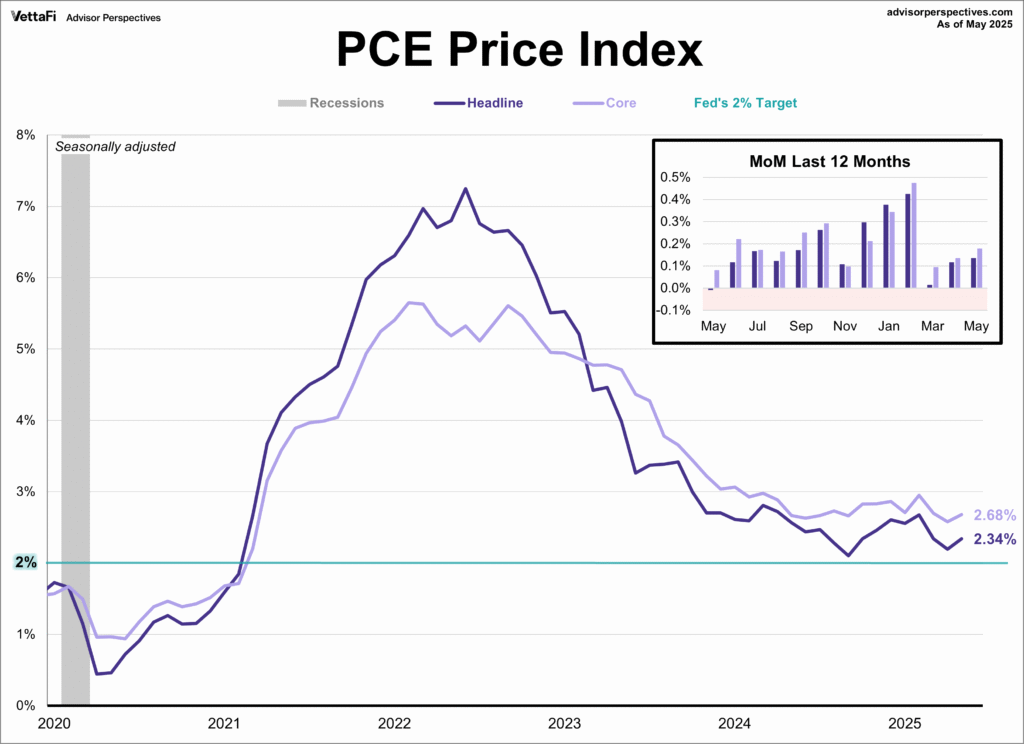

On June 27, 2025, the personal consumption expenditures price index (PCE) revealed a modest uptick in inflation for May, indicating persistent pressure above the Federal Reserve’s target rate of 2% annually. According to the recently released data, prices escalated by 2.3% from the same month last year, up from April’s 2.1% increase.

The core price index, which excludes the typically volatile sectors of food and energy, saw a rise of 2.7% on a year-over-year basis, compared to a 2.5% increase in April. These developments spotlight the ongoing challenges in bringing inflation under control and raise concerns among economists regarding future price stability.

Impact of Tariffs on Inflation

Despite these inflationary pressures, the broader implications of tariffs implemented during the Trump administration have yet to manifest significantly in consumer prices. Federal Reserve Chair Jerome Powell issued a warning earlier this week, cautioning that these import duties might lead to renewed inflationary pressures as they filter down to consumers in the coming months.

Recent reports from the Commerce Department indicate a reduction in consumer spending for May, marking the first decline since January. Economists noted that this 0.1% decrease in expenditures was likely a correction following earlier increased spending as consumers rushed to purchase goods ahead of impending tariff effects.

Greg Wilensky, a portfolio manager at Janus Henderson, noted, “While the spending figures have dipped slightly below expectations, we should consider this as a natural correction resulting from the previous surge in consumer demand driven by the anticipated tariffs.”

Consumer Income Trends

Moreover, household incomes also experienced a decline last month, primarily influenced by a one-time adjustment to Social Security benefits that previously inflated payments in March and April. This adjustment particularly affected certain retirees who worked in state and local government roles, under the provision of the Social Security Fairness Act.

Tariff Effects on Pricing Dynamics

The inflation statistics offer insight into the modest influence that President Trump’s tariffs have exerted on overall pricing trends. Some product categories, such as toys and sporting goods, have indeed seen price increases. However, these rises have generally been counterbalanced by decreases observed in the costs of new vehicles, airline tickets, and rental properties.

| Month | PCE Inflation Rate | Core Inflation Rate | Change in Spending |

|---|---|---|---|

| April 2025 | 2.1% | 2.5% | +0.5% |

| May 2025 | 2.3% | 2.7% | -0.1% |

Overall, these findings signal a degree of stability in inflation on a monthly basis, where the PCE increased by just 0.1% from April to May, echoing the same growth rate observed in the previous month. Core prices, however, climbed by 0.2%, surpassing the expectations of many economists.

Carl Weinberg, chief economist at High Frequency Economics, commented, “At this time, there’s little to warrant concern regarding inflation from this report. Nevertheless, the unexpected decline in consumer spending raises flags, marking the first such instance since the pandemic began, which warrants attention from the Federal Reserve.”