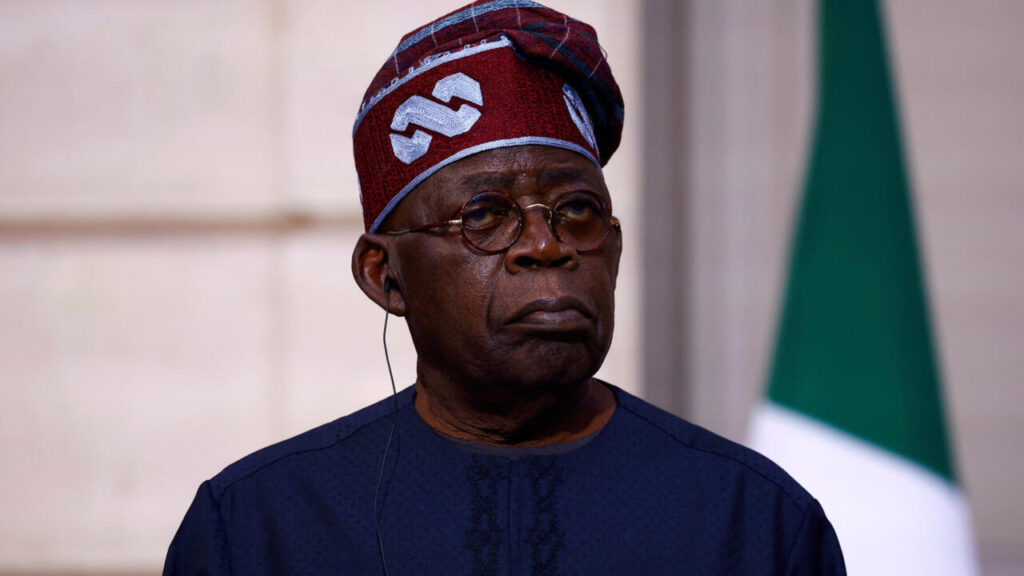

Nigeria’s Tax Reform: Key Changes Introduced by President Bola Tinubu

In a significant step towards revitalizing the tax landscape of Nigeria, President Bola Tinubu has enacted four pivotal finance bills aimed at overhauling the country’s tax system. These legislative measures are designed to streamline revenue collection, alleviate the tax burden on specific groups, and enhance the government’s fiscal capabilities through more efficient collection processes.

In a statement celebrating the second anniversary of his government, President Tinubu emphasized, “The tax reforms will protect low-income households and support workers by expanding their disposable income.”

Overview of the New Tax Laws

The newly signed legislation includes:

- The Nigeria Tax Act: This act consolidates multiple tax rules into a singular, user-friendly code and eliminates over 50 redundant taxes, aiming to simplify business operations.

- The Tax Administration Act: Establishes uniform guidelines for tax collection across federal, state, and local government levels.

- The Nigeria Revenue Service Act: Transitions from the Federal Inland Revenue Service to an independent Nigeria Revenue Service (NRS).

- The Joint Revenue Board Act: Facilitates improved coordination among government tiers by creating a Tax Ombudsman and a Tax Appeal Tribunal for dispute resolution.

Expected Impact of the Reforms

The reforms are expected to bring about significant changes, particularly for low-income earners, small businesses, and informal traders. Key features include:

- A rent relief of 200,000 naira ($130) for individuals earning up to 1 million naira a year, effectively exempting them from income tax.

- Exemptions from Value Added Tax (VAT) on essential goods and services, enabling families to better manage their basic needs.

- Small businesses with annual revenues below 50 million naira ($32,400) will no longer be liable for company income tax, alongside simplified filing processes.

- For larger enterprises, corporate tax rates will decrease progressively from 30% to 27.5% in 2025 and further to 25% thereafter, with added provisions for VAT credits on expenses.

- Charitable organizations, cooperatives, and educational institutions that do not engage in commercial activities will receive tax benefits.

Who Will Benefit Most?

Low-income families are likely to gain the most from these reforms, as many will no longer face income tax and will see reduced costs on essential goods. Small businesses may thrive under a less convoluted regulatory framework, fostering compliance and encouraging informal traders to join the tax system.

Challenges Ahead

There are apprehensions among some stakeholders regarding the practical execution of these reforms. Small business owners express concern over potential bureaucratic hurdles, with one businesswoman stating, “I like that we won’t have to pay company income tax anymore. But I hope they don’t introduce another inexplicable levy.”

Economist Emmanuel Idenyi cautions that the success of these reforms hinges on changing enforcement practices, highlighting that current revenue targets for tax officials could lead to fiscal burdens for businesses.

Public Reception and Future Outlook

The reception among the public has been cautiously optimistic. Taiwo Oyedele, who leads the Presidential Fiscal Policy and Tax Reform Committee, reported, “Ninety percent of Nigerians support the tax reform bills,” but underscored the importance of awareness and trust in the successful implementation of the reforms.

While opposition parties and labor unions have displayed muted responses, the Nigerian government remains committed to enhancing the tax system, which, as they argue, has long been outdated and inefficient.